fulton county ga vehicle sales tax

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. This is the total of state and county sales tax rates.

Fulton County To Add Additional Tag Renewal Kiosks In Atlanta

Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax.

. You can find these fees further down on the page. The Motor Vehicle Division of the Tax Commissioners Office assists citizens with titling and registering motor vehicle equipment as mandated by law. The Georgia state sales tax rate is currently.

Back Property and Vehicles. OFfice of the Tax Commissioner. GA 30303 404-612-4000 customerservicefultoncountygagov.

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 8 because the 1 regional TSPLOST does not apply. Get a Vehicle Out of Impound. The taxes are replaced by a one-time tax that is imposed on the fair market value of the.

Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Infrastructure For All. Please fully complete this form.

This is the total of state and county sales tax rates. The Georgia state sales tax rate is currently. In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees.

For TDDTTY or Georgia Relay Access. The tax rate for the first 500000 of a motor vehicle sale is 9 because all local taxes apply. Has impacted many state nexus laws and.

Sales Tax Bulletin - New Atlanta and Fulton County Sales Taxes. Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner. South Service Center 5600 Stonewall Tell Road Suite 224 College Park GA 30349.

Tax Lien Sale Refunds. Get a Vehicle Out of Impound. GA 30303 404-612-4000 customerservicefultoncountygagov.

The Fulton County sales tax rate is. Present your photo ID when you arrive to receive your bidder ID card. The Fulton County Sheriffs Office month of November 2019 tax sales.

Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. GA 30303 404-612-4000 customerservicefultoncountygagov.

Sales Tax Rates - General General Rate Chart - Effective April 1 2022 through June 30 2022 2219 KB General Rate Chart - Effective January 1. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner.

SUT-2017-01 New Local Taxes 13182 KB. Georgia collects a 4 state sales tax rate on the purchase of all vehicles. Please type the text you see in the image into the text box and submit.

Fulton County Initiatives Fulton County Initiatives. Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale. There is also a local tax of between 2 and 3.

Alpharetta Service Center 11575 Maxwell Road Alpharetta GA 30009. GA 30305 Kroger 800 Glenwood Avenue SE Atlanta GA 30316 Kroger 725 Ponce De Leon Ave NE. The City of Fulton has depended on the vehicle sales tax averaging between 40000 and 120000 each year to fund city projects.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Fulton County Government Center 141 Pryor Street Suite 1018 Atlanta GA 30303-3487. North Service Center 7741 Roswell Road NE Suite 210 Atlanta GA 30350.

TAVT is a one-time tax that is paid at the time the vehicle is titled. Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA. The sales tax also allows local dealerships to stay competitive as it removes any advantage to purchasing a vehicle outside of the state.

All taxes on the parcel in question must be paid in full prior to making a refund request. Kiosks will allow taxpayers to renew their vehicle registrations 24 hours a day 7 days a week. Bidder ID cards will not be issued after the tax sale is under way The information entered in the following application will be used to.

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Tax Sales - Bidder Registration. Registration renewals at the kiosks have no additional charges for Fulton County residents.

6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state. The 2018 United States Supreme Court decision in South Dakota v. Taxpayer Refund Request Form.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. Customer Service Center at Maxwell Road 11575 Maxwell Road Alpharetta GA 30009. The Fulton County Sales Tax is 3.

If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. The Fulton County Sales Tax is 26 A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. Title Ad Valorem Tax TAVT became effective on March 1 2013.

The kiosks are prominently located inside these high volume locations.

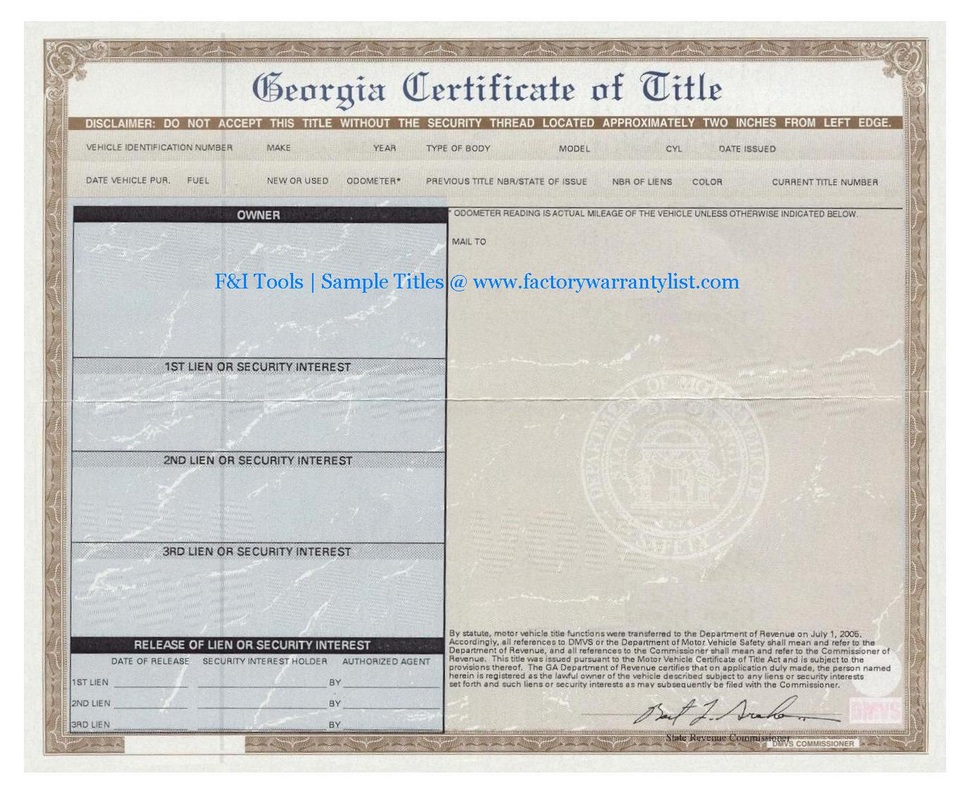

Georgia Title Transfer Buyer Instructions Youtube

How To Get A Georgia Bonded Title For A Car In 5 Steps Surety Bond Insider

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Sales Tax On Cars And Vehicles In Georgia

Line Striping For Envirospark G Force Atlanta

Georgia Car Registration A Helpful Illustrative Guide

Georgia Used Car Sales Tax Fees

Rivian Plant Approval Shifts To State Of Georgia After Local Opposition

How To Sell A Car In Georgia Transfer A Title And More

Tax Commissioner S Office Cherokee County Georgia

Motor Vehicle Division Georgia Department Of Revenue

Electric Car Makers Battle Georgia Auto Dealers To Sell Directly To Buyers

Brookhaven Based Tax Office Relocating To Chamblee Next Week

How To Get A Georgia Bonded Title For A Car In 5 Steps Surety Bond Insider

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

Interrupted Tag Title Services Occurring This Week